HELP TO BUY

Help to buy is the popular Government-funded Equity Loan which is available until 2021, this means that you can buy your new home with just a 5% deposit. With competitive mortgage rates available, now really is a great time to buy your new Heywood Home.

What is Help to Buy?

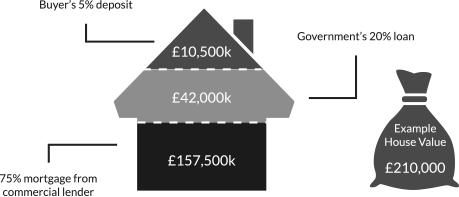

Help to Buy equity loan scheme means that you do not need the usual 10% deposit, you can move into your new home with just a 5% deposit and the government will lend up to 20% as an equity loan.

This allows

The scheme is available for both

Key facts for Home Buyers:

- The Help to Buy loan is an equity loan and not a shared ownership scheme meaning that you will own 100% of your new home.

- You will need a 5% deposit of the value of your new home and the government will put in a further deposit of

upto 20%. - By only needing to secure a 75% mortgage on your new home, you can access much more competitive mortgage products.

- This loan is interest-free for the first 5 years, helping you manage the initial cost of purchasing your new home.

- After five years you will be required to pay an interest fee of 1.75% of the amount of your Help to Buy shared equity loan at the time you purchased your property, rising each year after that by the increase (if any) in the Retail Prices Index (RPI) plus 1%.

- The loan itself is repayable after 25 years or on the sale of the property if earlier.

- You can repay your loan at any time, and any outstanding amount can be repaid in full when you sell your home to move up the property ladder.

- The scheme is available on new build homes up to the value of £600,000.

Who can use the scheme?

The scheme is available to first-time buyers and existing home owners. The home you buy must be your only residence and must be a new build property

How does it work?

“We used the help to buy scheme on our first home to help reduce the deposit, allowing us to afford to get on the property ladder and out of renting. We have chosen to use the scheme again when buying our Heywood home, to help us financially upgrade from our small existing first home to a bigger home in which we could look to start a family. The process is stress free and very easy! We would highly recommend it to anyone looking to buy their first or second home.”